This time last week I was at Internet Librarian in Monterey, California. AttaainCI earned AIIP’s technology award. Founder and President, Daryl Scott was present to receive the award from AIIP’s President, Marcy Phelps. Every year, the AIIP Technology Award is presented to a company whose product, in the panel’s opinion, best assists independent information professionals in locating, analyzing, organizing and delivering information.AttaainCI software, was launched in early 2008, and provides real-time intelligence gathering, analysis, sharing and reporting alerts. One of my favorite uses is company tracking: your company, one you want to acquire or a competitor, for example. Track what’s being said about your company’s products or your key customers. It is reasonably priced at $149 per month for the first user and $69 for the second user for unlimited usage on a month-to-month basis. Discounted annual plans are negotiable with Attaain. Watch 10 instructional videos and learn in detail how AttaainCI will work for you.

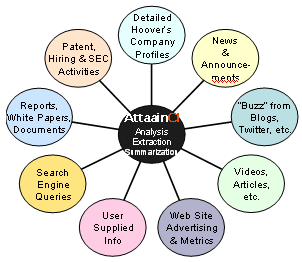

AttaainCI continuously monitors, filters and integrates intelligence from a wide range of sources.

The software had its start mostly tracking social networks such as Facebook, Twitter, LinkedIn among others. Recently AttaainCI included Hoovers as a resource for information, greatly boosting its one-stop shopping appeal for research. You can use it both for a one-time research project, for example a company or person; and you can receive email alerts delivered to your mailbox according to a personalized schedule. It is cooperative in that you can share results with co-workers and view results more visually.

The typical output for a one-time company research query might be 3 or 4 pages of data that is easy to scroll through, as the abstracts appear neatly in 4 columns: Search Results, News & Announcement, Blog Mentions and Additional Intelligence. You can quickly connect to the best articles or reports to get up to speed on the topic you’re researching. You can also find out who is talking about that topic through your social networks. I find it is useful since I have a huge LinkedIn network, so I always find relevant people to follow-up with. Similarly I often can connect to good people on Twitter, who lead me to others once I determine the # for the topic in question, like #eldercare. If you need more information than what is on those several pages, AttaainCI provides links to even more data right off the initial report.

AttaainCI is a good software package to get up to speed on just about any topic, and it’s great to use at the outset of a project whether it’s competitive intelligence or general research for sales, marketing, product management or strategic planning. AttaainCI is an effective tool for daily monitoring on topics to get the latest and greatest while you’re working on a project, which goes on for two weeks to a month, for example. Find out what people are saying about you, key executives, your products, and your company through AttaainCI. AttaainCI will greatly reduce your communication time for intelligence deliverables.

Filed under: AIIP, communication, Competitive Intelligence, cooperative, LinkedIn, product development, research, social networks, Twitter | Comments Off on AttaainCI wins AIIP’s 10th Annual Technology Award

In the spirit of

In the spirit of  Marcia Rodney

Marcia Rodney On Saturday night we enjoyed a nice dinner with friends. The next morning, we noticed that our tent flap was open. It was a sick feeling and my husband’s painting,

On Saturday night we enjoyed a nice dinner with friends. The next morning, we noticed that our tent flap was open. It was a sick feeling and my husband’s painting,

Competitive intelligence (CI) is the process of gathering valuable information about your firm’s direct and indirect competitors including strategies, plans, practices or people. Companies value CI and its opposite,

Competitive intelligence (CI) is the process of gathering valuable information about your firm’s direct and indirect competitors including strategies, plans, practices or people. Companies value CI and its opposite,