Recently I was interviewed by Adam Sutton of MarketingSherpa, and in the spirit of cooperative intelligence I am sharing some highlights. For the full article you need to subscribe to MarketingSherpa. Check out MarketingSherpa’s free trial. It is chock full of marketing information, studies, white papers and current articles like this one. I will summarize each of the five tactics, and then blog on each of them individually this month.

Tactic #1 Conduct win loss analysis

Interview new customers and prospects you lost to the competition. Your goal is to uncover the motivations behind their decisions and to learn whatever great information they impart to help improve product development, tweak your existing products or service, change your marketing message, learn how your competitors are successfully unseating you and so much more.

I recommend you conduct these interviews in cooperation with your sales force, rather than behind their back. Building trust with Sales is the biggest reason to include them as part of the win loss analysis process. Sales can save you so much time by telling you how the people you’re going to interview are motivated to share. Wow, that reason alone is enough to work with Sales.

Tactic#2 Talk to internal and external experts

Use a cooperative approach when connecting with internal and external experts. People inside your company tend to know a lot about your industry and can connect you with external contacts who might be helpful. Be sure to thank your experts and send them information you come across that they might find helpful. This two way communication and connection is invaluable to your knowledge pool.

Tactic #3 Use trade shows as fact-finding missions

Trades shows are the biggest Meccas for competitive intelligence. No where are there more people who want to share their knowledge and insight with you: industry experts, prospects, competitors and journalists.

Do your homework: Prepare a game plan before the conference. Study the exhibitor floor plan and all the presentations and decide how best to use your time and write out the questions you will ask to the various audiences. Keep the plan rough as you’ll need to be flexible since you’ll need to jump on opportunities as they arise, which you can’t predict.

Be observant. Most people think about gathering competitive intelligence from competitor’s exhibit areas and formal presentations, but sometimes the best intelligence is gathered at informal settings such as the conference coffee shops, the conference hotel cafe, the elevator, cocktail parties, the bus ride to the airport, even in the airplane.

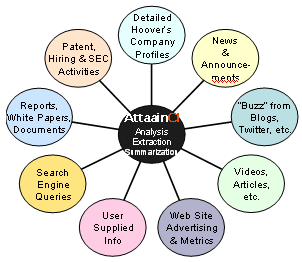

Tactic #4 Build an information database

Build a database for all the information you have on the competition and the marketplace that can easily be browsed and that is easily kept up-to-date. Also build a database of contacts both internal and external to your company who are great sources of information about your industry, the marketplace, the competition…and make this sortable as well! This quick access to contacts and information greatly speeds up your research timeline!

Tactic #5 Remain ethical and avoid deception

Make sure anyone you use to collect information is operating under the same ethical standards as held by your company. Check out SCIP’s website for its code of ethics.

Remember I will provide more detail about each of these 5 tactics in future blogs.

Filed under: communication, Competitive Intelligence, connection, cooperative, Cooperative Intelligence, product development, research, SCIP, trade show, win loss analysis | 5 Comments »